Leading privacy and security company ExpressVPN today introduces Credit Scanner, an innovative credit monitoring service designed to help U.S. users protect their credit scores and identity—all included within the ExpressVPN app. Credit Scanner offers real-time credit activity monitoring, allowing users to take swift action against potential identity theft and secure their financial future.

Credit monitoring is essential in today’s digital landscape, where identity theft is on the rise. By tracking changes in credit scores and financial activity, Credit Scanner empowers users to detect and address suspicious activity before it impacts their credit.

Sam Bultez, Head of Product, says: “Credit Scanner is the latest addition to ExpressVPN’s recently introduced Identity Defender suite. We wanted to do more to help our users take control of their online identity and financial security. Each Identity Defender tool focuses on a different aspect of identity protection, and together these tools provide users with a holistic approach to safeguarding their online identity. Combined with ExpressVPN’s premium VPN, Keys password manager, and advanced protection features, Identity Defender adds a robust, multi-layered approach to security.”

![]()

Credit Scanner enables users to:

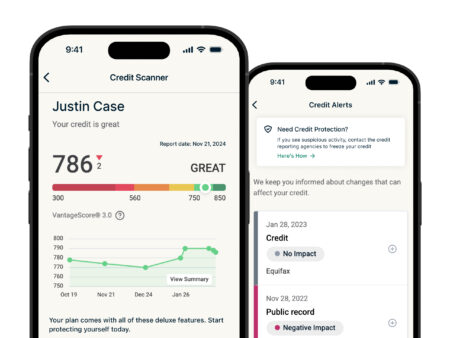

- Monitor Credit Scores and Activity: Easily track changes in users’ credit score, payment history, and account balances with regular updates.

- Early Fraud Detection Alerts: Receive timely notifications on unusual credit activity, helping users catch identity theft early and take corrective measures.

- Credit Protection Information: Convenient access to credit-freezing options, giving users more control over protecting their credit.

- Monthly Credit Report Access: With ExpressVPN’s 2-year subscription plan, users gain exclusive access to monthly detailed credit reports, providing a comprehensive view of their financial standing.

Digital Privacy Advocate Lauren Hendry Parsons says: “Many Americans have a hard time managing credit, partly because financial and digital literacy isn’t widely taught. Credit has moved online, so it’s not just about knowing how to manage a budget—people also need digital skills to track scores, manage accounts, and protect their information. Without this, people can fall victim to scams or data breaches that impact their credit and finances. When credit information isn’t protected or well-understood, it’s easy to slip into debt, hurt credit scores, fall victim to scammers or even be impersonated. Better access to financial and digital literacy and straightforward tools can empower people to manage their credit and digital identity more confidently and safely.”

Credit Scanner is available to new ExpressVPN users in the U.S. who signed up after November 20, 2024, as part of ExpressVPN’s one- or two-year subscription plans. U.S. users on a 2-year plan also benefit from a detailed monthly credit report.

Visit ExpressVPN.com to find out more about Credit Scanner and the broader Identity Defender suite of tools.